Engagement & Retention project | Simpl

Hi there, we'll take this one step at a time!

If you struggle with a blank canvas, use this boilerplate to start. Remember, this is a flexible resource—tweak it as needed. Some sections might not apply to your product and you might come up with great ideas not listed here, don't let be restricted.

This is not the only format, we would love to see you scope out a great format for your product!

Go wild and dive deep—we love well-researched documents that cover all bases with depth and understanding.

Please delete any unused boilerplate material before making your final submission.

Let’s begin!

Know what your product is, its features, what problem its solving. Draft the CVP of your product, its natural frequency and engagement framework.

Know your users, what they value the most and define who is your active user.

Core Value Proposition

Simpl's core value proposition is to offer a seamless, flexible payment experience through its "Buy Now, Pay Later" and "Pay in Three" models. It enables consumers to make purchases without upfront payment, offering interest-free installments and instant credit access. The core differentiator is the single click checkout, that creates an AHA moment for the user.

For merchants, Simpl enhances checkout, reduces cart abandonment, and drives higher sales by providing a frictionless payment solution. Simpl allows customers to increase the cart value and build a habit of frequent shopping for the user.

User Experience

One click checkout when placing an order, without the complication of OTP or CVV. Perks of using Simpl consistently that allow for the user to increase the credit limit. The payment options also come with cashbacks and offers that target the consumer's need of 'getting the best deal'. Users can instantly access credit without complex processes, with transparent fees and no hidden charges. The entire experience is designed to be frictionless, ensuring users can shop confidently and manage payments effortlessly.

User Engagement Frequency & Insights

Casual Users

- Frequency: Once a month

- Engagement Pattern: Casual users tend to interact with the product on a less frequent basis, perhaps due to specific needs or occasional use cases. Their interactions may be triggered by a need or event rather than habitual usage. For example, Muskaan explained in a user call that she uses Simpl pay in 3 to make the most of Myntra sale occasionally.

- Key Insight: Targeted reminders or updates about new features or events could help convert casual users to core users by sparking interest and engagement more regularly.

Core Users

- Frequency: 3-5 times a month

- Engagement Pattern: Core users are more consistent in their interactions, often integrating the product into their routine for specific, recurring needs. They may use it for utility or as a tool to solve ongoing problems. For example, Udai uses Simpl buy now pay later frequently on quick commerce and food ordering platforms. However, when he places his monthly groceries order, he uses his debit card.

- Key Insight: Offering tailored content or features based on their usage patterns could improve user satisfaction and retention. Deepening their relationship with the product could shift their behavior toward the higher engagement level of power users.

Power Users

- Frequency: 6-10 times a month

- Engagement Pattern: Power users engage with the product frequently, using it regularly as part of their day-to-day routine or leveraging its full feature set. Their deep engagement often indicates a high level of satisfaction, and they may act as product advocates. For example, Shivam uses Simpl buy now pay later almost every third day with quick commerce and pay in 3, once a month and billbox once a month to pay utility bills.

- Key Insight: For this group, regular updates, new features, or challenges that encourage deeper exploration could reinforce loyalty and potentially lead to organic advocacy. Personalized experiences based on their activity can enhance their overall satisfaction and longevity.

How These Insights Can Drive Strategy

- Personalization: By understanding user patterns, we can tailor the experience to each group, encouraging more frequent use among casual and core users.

- Retention: Power users’ engagement patterns can inform retention strategies, ensuring they feel valued and consistently engaged with new and relevant features.

- Growth: By converting casual users into core or power users, we can foster a stronger user base and increase overall usage, driving both retention and growth.

Engagement Framework

Simpl's engagement framework is depth : The number of transactions and the total spend

- Number of Transactions: This metric is key to understanding the habit of the user. The more number of transactions the user completes via Simpl, the deeper the habit sets in. The perceived value of the product keeps increasing as the user understands that they only have to make payment once in 15 days to Simpl, reducing their effort and adding convenience of deferred payment.

- Total Spend: The higher a consumer spends, the more credit limit they get, which acts as the flywheel for repeated engagement with the product.

A higher depth indicates stronger user engagement, as it shows not only frequent usage but also significant spending, which are key drivers for Simpl's growth and long-term customer loyalty.

Active User

An active user for Simpl is someone who has completed 2 transactions on Simpl Pay Later, within the duration of 15 days and cleared the bill without any late fees/penalty. This reflects a user who is consciously using Simpl for solving a pain point.

Additionally, an active user for Simpl can also be someone who uses Simpl Pay in Three to purchase one product in a month, and regularly clears the 3 installments on time. This indicates a user who finds value in Simpl's core offering and has built a habit of using it.

build your ICP's- by now you know how to do that in a tabular format as done in earlier projects and segment the users, think about why you are segmenting and what is the goal of your product and segmentation

Figure out the retention data for your product. If you don't have access to the same, begin by adjusting the industry standards. Plot down the data and bring to life your retention curve. Draw out observations and insights from the same.

What is causing your users to churn?

Go back to your user insights and figure out the number one reason of churn by listing down all the factors.

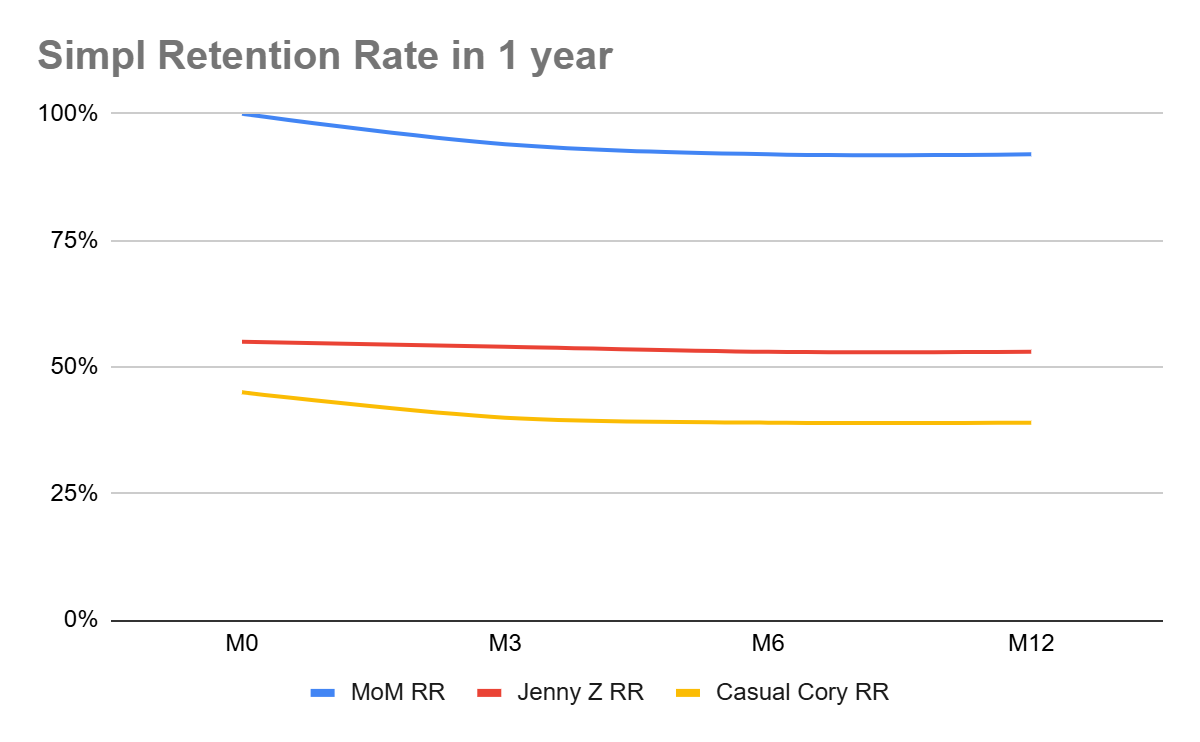

Simpl's retention rate is 90% - 95% as obtained through secondary data :

The current user base for Simpl is 25 Million

MoM RR | Total Users | Jenny Z RR | Jenny Z Users | Casual Cory RR | Casual Cory Users | |

M0 | 100% | 25 | 55% | 13.75 | 45% | 11.25 |

M3 | 94% | 23.5 | 54% | 7.425 | 40% | 4.5 |

M6 | 92% | 23 | 53% | 7.2875 | 39% | 4.3875 |

M12 | 92% | 23 | 53% | 7.2875 | 39% | 4.3875 |

Insights & Observations

Both ICPs have a smilar retention rate, however the number of Jenny Z users is higher that Casual Cory. The reason for that is word of mouth is very strong in Jenny Z. This ICP is advocating for Simpl. The reason why the retention curve for Jenny Z is slightly flatter is because this ICP is making use of the core value proposition and is not swayed by any other competing product. For this ICP, the one click check out is one of a kind.

For Casual Cory, there is a slightly steeper retention curve and potential reasons for that could be that this ICP has a few more alternatives available. This ICP is loyal but can find greater value in credit cards that allow them to collect more points and is available EVERYWHERE.

While Simpl's merchant base has reached 26000, it has increased recently. Therefore, in the recent past, users could be churned to have grander access to merchants. Something that Casual Cory could have switched for.

Reasons for Churn | Voluntary | Involuntary |

|---|---|---|

Better Rewards on Credit Card Tendency to forget to clear Simpl Bill Did not understand how the product works | Not ordering as much online anymore Increasing fraud in the world Change in preference regarding openness to credit payment options | |

Going back to user insights, the number one reason for users to churn was better rewards on credit cards, followed by forgetting to clear Simpl Bill. This insight came from speaking to churned users.

User 1 : I stopped using Simpl as I use multiple payment options on various platforms. So, I would forget to clear the Simpl bill. I know they send reminders but it just got missed a couple of times.

User 2: I tried Simpl because it looked super convenient, while ordering food. But it doesn't give the best deal a lot of times. Also, it is present on select platforms. Credit cards are just way cooler with respect to lounge access/points and are great when traveling internationally. So, I tend to use that now as a standard payment option.

Negative actions to look out for to identify churned users

- Number of users who are paying the late fee for clearing the bill. If this number is increasing, it means the reminder system is not working, which means the user is unable to experience the core value proposition of one time payment in 15 days without any fee or charge. Therefore, this user is at risk of churn.

- Number of users clearing the Simpl bill via the payment link, and not through the app. If this number is increasing, it implies users are not experiencing the core value proposition of transparency. Without the app, the user is unable to track number and volume of transactions, thereby not experiencing the benefits.

The insights you've shared provide a great foundation to analyze Simpl's user retention trends, user behaviors, and the factors influencing churn. To elevate this analysis, we can connect these findings to broader industry insights, particularly in payment products, consumer behavior, and retention strategies. Here’s how we can integrate your observations with industry trends and further refine the strategy:

Broader Industry Insights:

- The Power of Word-of-Mouth Marketing (Jenny Z ICP)

- Industry Trend: Word of mouth (WOM) continues to be one of the strongest drivers of customer acquisition, particularly in younger generations. According to Nielsen’s 2020 Global Trust in Advertising report, 92% of consumers trust recommendations from friends and family over any other form of advertising.

- Connection to Jenny Z ICP: Jenny Z users, who are advocating for Simpl, are likely in the younger demographic that values convenience, tech innovation, and peer recommendations. Their retention curve is flatter because they are using the core value proposition (one-click checkout) frequently and consistently, which aligns with industry data indicating that younger consumers are highly loyal to brands that meet their immediate needs with simplicity and ease.

- Strategic Insight: Simpl can further capitalize on word-of-mouth and advocacy by building referral programs, engaging Jenny Z users through social media, and empowering them to become brand ambassadors. Simpl could also explore partnerships with influencers in the space to amplify WOM.

- The Loyalty-Reward Challenge (Casual Cory ICP)

- Industry Trend: Credit card companies and digital wallets have increasingly offered more attractive rewards programs, such as cash-back, travel points, and access to exclusive benefits. According to a 2023 study by J.D. Power, the most popular reason consumers choose a specific payment method is the rewards they can accrue.

- Connection to Casual Cory ICP: Casual Cory’s loyalty is being tested by credit cards offering greater rewards and benefits (e.g., travel perks, point accumulation). The increasing competition from credit card companies aligns with the broader trend where consumers are more willing to switch payment methods for better rewards. Furthermore, the fact that Cory is more likely to switch to options that offer value across a broader range of merchants speaks to the rise of universal payment systems (e.g., digital wallets, integrated platforms) that serve as a one-stop solution.

- Strategic Insight: Simpl could explore creating partnerships with more merchants to broaden its appeal or develop unique, compelling reward systems (e.g., simplifying loyalty points or integrating exclusive perks) to differentiate itself from credit card providers. Offering partnerships with travel or lifestyle brands could target users like Cory who are motivated by rewards and travel benefits.

- The Impact of Platform Availability (Casual Cory ICP)

- Industry Trend: Availability on multiple platforms is crucial for retention. Users are increasingly adopting multi-platform usage, and if a service is available only on select platforms, it can create friction in the customer experience. According to PwC’s 2020 Global Consumer Insights Survey, 73% of consumers want brands to provide a seamless, consistent experience across all touchpoints.

- Connection to Casual Cory ICP: Cory’s tendency to prefer widely available payment options underscores the importance of multi-channel access. If Simpl is not integrated on popular e-commerce sites or platforms, this friction can lead to churn.

- Strategic Insight: Expanding the merchant base and increasing platform accessibility would improve retention. Simpl should focus on integrating with major e-commerce platforms, digital wallets, and other online retailers to ensure customers can use it wherever they shop.

- User Forgetfulness & Financial Discipline (Churn Causes)

- Industry Trend: Forgetting to make payments on time is a common pain point in financial products. Companies like credit card providers have focused heavily on user reminders, automated payments, and financial discipline tools. A 2021 report by FICO found that 40% of people use some form of automated payments to avoid missing due dates.

- Connection to Churn (Forgetting to Clear the Bill): User feedback (e.g., User 1) about forgetting to clear the Simpl bill highlights a critical challenge in user experience. This problem is not unique to Simpl, as it’s a common pain point in the payment industry. However, failure to address this can create a gap between users experiencing the core value proposition (paying bills on time without fees) and the reality (forgetting payments and incurring late fees).

- Strategic Insight: Improving reminder systems (e.g., in-app, email, SMS reminders) is critical. Additionally, Simpl could offer more seamless ways for users to auto-clear their bills or enable a feature that allows users to “pause” payments temporarily to avoid accruing late fees. A rewards or incentive system for on-time payments could also drive positive financial behaviors.

- The Risk of Fraud (Increasing Fraud in the World)

- Industry Trend: Payment fraud is an ever-growing concern. According to a 2022 report by the European Central Bank, payment fraud has been on the rise, with digital transactions being particularly vulnerable to fraud attempts.

- Connection to Churn (Fraud Concerns): As fraud becomes more prevalent, users are becoming more cautious about sharing payment details. Users may be hesitant to use Simpl if they perceive any risk in terms of security or fraud prevention, contributing to churn.

- Strategic Insight: Simpl should focus on enhancing security measures, such as two-factor authentication (2FA), end-to-end encryption, and fraud monitoring systems. Communicating these security features clearly to users will help build trust and reduce concerns about fraud.

Strategic Recommendations:

- Strengthen Advocacy with Jenny Z (Word of Mouth):

- Foster user advocacy through referral programs, influencer collaborations, and creating exclusive experiences for high-value users. Simpl should leverage the WOM strength of Jenny Z to organically grow its user base.

- Develop gamified referral incentives where users are rewarded for sharing Simpl with others or leaving positive reviews.

- Enhance Rewards & Value Proposition for Casual Cory:

- Consider integrating more robust reward systems that appeal to Cory’s love for credit cards and travel rewards. Partnering with airlines, hotels, or online retailers could provide compelling reasons to use Simpl over other payment options.

- Expand the merchant base to make Simpl more universally accepted across major platforms, ensuring Cory doesn’t feel the need to switch.

- Address Payment Reminders and Automation:

- Improve the reminder system and enable features like auto-payment or "payment pause" for users who might forget to clear their Simpl bill. This would reduce friction and ensure users continue to enjoy Simpl's core value proposition.

- Introduce incentives for on-time payments or a loyalty program that rewards financial discipline, which could further increase user retention.

- Increase Focus on Security and Fraud Prevention:

- Given the rise in fraud, Simpl should ensure users feel confident in the security of their transactions by highlighting security features. Regular updates on fraud prevention and secure payment methods can help increase trust and reduce churn.

By connecting Simpl’s retention and churn insights with broader industry trends, strategies can be fine-tuned to meet user needs more effectively, enhance retention, and reduce churn.

You have already created the engagement campaigns, resurrection campaigns are quite similar just keep in mind the churned users that are being targeted here.

(customized your campaigns as per the ICP you're targeting to bring back, add parameters accordingly)

We hope this helped you break the cold start problem!

Reminder: This is not the only format to follow, feel free to edit it as you wish!

To re-engage Simpl's churned users, the two identified ICPs, Jenny Z and Casual Cory, the following resurrection campaigns can be run, addressing their specific reasons for churning.

1. Simpl Bill Reminder and Payment Automation (Targeting Jenny Z)

Stage of Churn: Early Churn

- Why this stage? Jenny Z users are typically forgetful about bill payments, meaning they haven't fully disengaged with Simpl yet. They're still in the “potential to re-engage” phase, but their retention is threatened by missed payments.

- Campaign Rationale:

- Goal: Prevent churn by offering a solution to the core reason they left—missed bill payments. In the early churn stage, users are more likely to respond to solutions that fix the immediate pain point (like automated bill payments).

- Frequency and Timing: A reminder a few days before the payment is due provides enough time for them to act, while the follow-up 2 weeks later ensures they haven’t forgotten again and reinforces the value of the solution.

- Pitch/Content:

- "Never Miss a Payment Again! Set Up Auto Payments for Seamless Transactions."

- Highlight the convenience of automated bill payments and the benefits of avoiding late fees or penalties. Emphasize peace of mind with auto-payment features and smart reminders.

- Offer (Incentive): Offering a cashback (e.g., ₹250 cashback or a small discount) will be enough to push users to take action (enable auto-pay) without overwhelming them with too much complexity.

- Success Metrics: Aiming for a high activation rate for auto-pay (directly solving their problem), and a reduction in churn due to late payments.

- Activation rate of auto-pay.

- Reduction in churn for users who previously missed payments.

- Increase in repeat transactions from re-engaged users.

2. Credit Card Comparison and Better Value Proposition (Targeting Casual Cory)

Stage of Churn: Mid to Late Churn

- Why this stage? Casual Cory has likely already found alternatives (credit cards with better rewards) and has switched to using them more consistently. They are in the mid-to-late churn stage, meaning they have some emotional detachment from Simpl and may have started using another payment solution.

- Campaign Rationale:

- Goal: Remind users of Simpl’s unique benefits (flexibility, zero interest) and highlight why it is still the better choice over their current alternative (credit card with rewards).

- Frequency and Timing: Early follow-up after churn (within 1-2 weeks) will help you reach them while their decision to switch is still fresh in their mind. By offering them cashback or discounts, you're incentivizing them to try Simpl again, and by showing how credit cards have hidden fees, you're reintroducing Simpl as the “transparent” solution.

- Pitch/Content:

- "Get More with Simpl: Transparent, Flexible Payments Without Hidden Fees!"

- Focus on the ease of using Simpl for day-to-day purchases with no complicated fees, unlike traditional credit cards, which may come with interest and hidden charges.

- Offer (Incentive):

- The limited-time discount (5% cashback) and emphasizing the zero-interest option position Simpl as an appealing alternative to credit cards that could resonate with Cory’s financial habits.

- Highlight the zero-interest feature (for eligible installments) versus credit card interest rates.

- Success Metrics: Focus on re-engagement rates and incremental spend from these users, as you want them to actively use Simpl again for purchases.

- Re-engagement rate (users making a new purchase).

- Conversion of churned users to active users again.

- Incremental spend from re-engaged users

Your campaign designs are quite comprehensive and well-thought-out, focusing on specific reasons for churn and tailoring the campaigns to meet the needs of your two ICPs—Jenny Z and Casual Cory. To elevate these campaigns, we’ll refine them by integrating the stage of churn for each segment, which influences how we design each campaign component. This includes understanding whether the user is in the early churn stage (still recalling their decision to leave) or in the late churn stage (already engaged with competitors or disengaged from Simpl).

Here’s how we can connect the stage of churn to the campaign components and provide the rationale behind each:

1. Simpl Bill Reminder and Payment Automation (Targeting Jenny Z)

Stage of Churn: Early Churn

- Why this stage? Jenny Z users are typically forgetful about bill payments, meaning they haven't fully disengaged with Simpl yet. They're still in the “potential to re-engage” phase, but their retention is threatened by missed payments.

- Campaign Rationale:

- Goal: Prevent churn by offering a solution to the core reason they left—missed bill payments. In the early churn stage, users are more likely to respond to solutions that fix the immediate pain point (like automated bill payments).

- Frequency and Timing: A reminder a few days before the payment is due provides enough time for them to act, while the follow-up 2 weeks later ensures they haven’t forgotten again and reinforces the value of the solution.

- Offer (Incentive): Offering a cashback or small discount will be enough to push users to take action (enable auto-pay) without overwhelming them with too much complexity.

- Success Metrics: You’re aiming for a high activation rate for auto-pay (directly solving their problem), and a reduction in churn due to late payments.

2. Credit Card Comparison and Better Value Proposition (Targeting Casual Cory)

Stage of Churn: Mid to Late Churn

- Why this stage? Casual Cory has likely already found alternatives (credit cards with better rewards) and has switched to using them more consistently. They are in the mid-to-late churn stage, meaning they have some emotional detachment from Simpl and may have started using another payment solution.

- Campaign Rationale:

- Goal: Remind users of Simpl’s unique benefits (flexibility, zero interest) and highlight why it is still the better choice over their current alternative (credit card with rewards).

- Frequency and Timing: Early follow-up after churn (within 1-2 weeks) will help you reach them while their decision to switch is still fresh in their mind. By offering them cashback or discounts, you're incentivizing them to try Simpl again, and by showing how credit cards have hidden fees, you're reintroducing Simpl as the “transparent” solution.

- Offer (Incentive): The limited-time discount (5% cashback) and emphasizing the zero-interest option position Simpl as an appealing alternative to credit cards that could resonate with Cory’s financial habits.

- Success Metrics: Focus on re-engagement rates and incremental spend from these users, as you want them to actively use Simpl again for purchases.

3. Reactivation Incentive Program (Targeting Jenny Z and Casual Cory)

Stage of Churn: Late Churn

- Why this stage? This campaign targets late churn users, as it is designed for those who are already fully disengaged, possibly using a competing product or having simply stopped using Simpl. For both Jenny Z and Casual Cory, this campaign brings them back with a fresh incentive.

- Campaign Rationale:

- Goal: Provide a compelling reason to reactivate the account and test Simpl again, offering a unique value proposition based on their specific pain points.

- Frequency and Timing: A multi-touch approach (3 WhatsApp messages) gives enough time for users to digest the offer and reconsider, starting early after churn to maximize the chances of reactivation. The final reminder after 4 weeks ensures users have had enough time to consider their options and aren’t too deeply attached to competitors yet.

- Pitch/Content:

- "Simpl just got cooler! Customize your billing cycle and Unlock Exclusive Rewards!"

- Personalized messaging targeting their pain points: “Avoid Late Fees” for Jenny Z and “Get More Value than Your Credit Card” for Cory. Tailor the content to remind them of Simpl’s unique value proposition. Highlight the feature of customizing billing cycle and setting up auto debit.

- Offer (Incentive): Offering ₹200 cashback or exclusive early access to a merchant sale gives users an immediate, tangible benefit for returning, which is crucial when they're in the late churn stage and less emotionally invested.

- Success Metrics: Focus on re-engagement rate and retention rate post-promotion, aiming for a higher proportion of users to remain active after the initial reactivation incentive.

- Re-engagement rate (percentage of users who re-activate their accounts and complete a transaction).

- Retention rate (percentage of users who remain active post-promotion).

- Increase in active users compared to previous churn periods.

4. Personalized Offers Based on Usage Behavior (Targeting Jenny Z and Casual Cory)

Stage of Churn: Early to Mid Churn

- Why this stage? Since you are using data-driven personalization, this campaign targets early-to-mid churn users who might still have positive associations with Simpl but were enticed away by competing offers. They’ve likely been using Simpl for specific categories (like groceries), so personalized offers can draw them back with a tailored incentive.

- Campaign Rationale:

- Goal: Drive re-engagement by making users feel valued and understood, through a customized offer based on their previous spending habits.

- Frequency and Timing: Since these users are in the early stages of churn, sending a personalized WhatsApp message within a week of churn and following up 2 weeks later allows you to re-engage them while their decision to leave is still relatively fresh.

- Pitch/Content:

- "We Miss You! Here’s a Tailored Offer Just for You."

- Use data from previous transactions to create personalized offers. For example, if they frequently used Simpl for grocery shopping, offer specific discounts on their next grocery order.

- Offer (Incentive): Tailoring cashback or discounts to their previous purchases (e.g., 10% off on next groceries order) increases the likelihood of re-engagement by making the offer feel personally relevant to their needs.

- Success Metrics: Key metrics would include engagement rate (open rates) and conversion rate (how many users act on the personalized offer).

- Open rates and engagement rates of personalized emails.

- Re-engagement rate based on personalized offers.

- Conversion rate (how many re-engaged users made a purchase).

5. Social Proof and User Testimonials (Targeting Both Jenny Z and Casual Cory)

Stage of Churn: Late Churn

- Why this stage? Late churn users are already highly disengaged and likely entrenched in using competitors. They need external validation to convince them to return to Simpl, hence the use of social proof.

- Campaign Rationale:

- Goal: Rebuild trust and loyalty by showing how others are benefiting from Simpl, counteracting their disconnection with stories of value and convenience.

- Frequency and Timing:

- Since this is a trust-building campaign, timing is crucial—sending it within 1-2 weeks of churn helps rekindle interest before the user becomes too loyal to alternatives.

- One email with testimonials, followed by a reminder whatsapp 5 days later.

- Pitch/Content:

- "See How Other Users Are Saving More with Simpl!"

- Use testimonials and case studies of users who have benefited from Simpl’s flexibility and savings. Emphasize how Simpl is more user-friendly and transparent compared to traditional credit cards.

- Offer (Incentive):

- Get ₹150 bonus for reactivation combined with social proof acts as both a financial and emotional incentive to reconsider Simpl as a valid payment solution.

- Offer a limited-time bonus (e.g., ₹150) for users who use any product of Simpl. If earlier they were using Simpl Pay Later, pitch Pay in 3!

- Success Metrics: Reactivated accounts and social shares are key metrics, as this campaign leverages the power of trust and peer influence.

- Number of reactivated accounts.

- Social shares or referrals as part of the campaign.

- Conversion rate of users who saw testimonials and then made a purchase.

Final Thoughts and Campaign Design Rationalization:

By understanding the stage of churn for each ICP (Jenny Z and Casual Cory), we’ve tailored the campaign components to be most effective at each stage:

- Early churn users benefit from solutions to immediate pain points (e.g., auto-payment, personalized offers).

- Mid-to-late churn users need more substantial incentives and social proof to convince them to re-engage with Simpl.

Each campaign component—whether frequency, timing, offer, or content—aligns with the churn stage and user needs, ensuring that the right message is delivered at the right time, increasing the likelihood of successful re-engagement and retention.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.